nh food sales tax

Nh Food Tax Calculator. The state does tax income from interest and dividends at.

When Did Your State Adopt Its Sales Tax Tax Foundation

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

. West Chesterfield NH Sales Tax Rate. Advertisement Its a change that was proposed by Gov. The state meals and rooms tax is dropping from 9 to 85.

West Lebanon NH Sales Tax Rate. Granite Tax Connect GTC is available for Meals Rentals Business Profits Business Enterprise Interest Dividends Communication Services Medicaid Enhancement Nursing Facility Quality. West Nottingham NH Sales Tax Rate.

Chapter 144 Laws of 2009 increased the rate from 8 to the. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9. A 9 tax is also assessed on motor.

Prepared Food is subject to special sales tax rates under New Hampshire law. There are however several specific taxes levied on particular services or products. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Chris Sununu in this years budget package which passed.

File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. North Dakota Nearly all sales of prepared food or meals by hotels restaurants convenience stores delicatessens concession stands coffee shops other eating places and.

New Hampshire is one of the few states with no statewide sales tax. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. All taxes upon tobacco products are direct taxes.

Wentworth NH Sales Tax Rate. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

The tax rate for all other tobacco products OTP except premium cigars is 6503 of the wholesale sales price. These excises include a 9 tax on.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

States Without Sales Tax Article

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy

How Do State And Local Sales Taxes Work Tax Policy Center

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

New Mexico Sales Tax Small Business Guide Truic

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

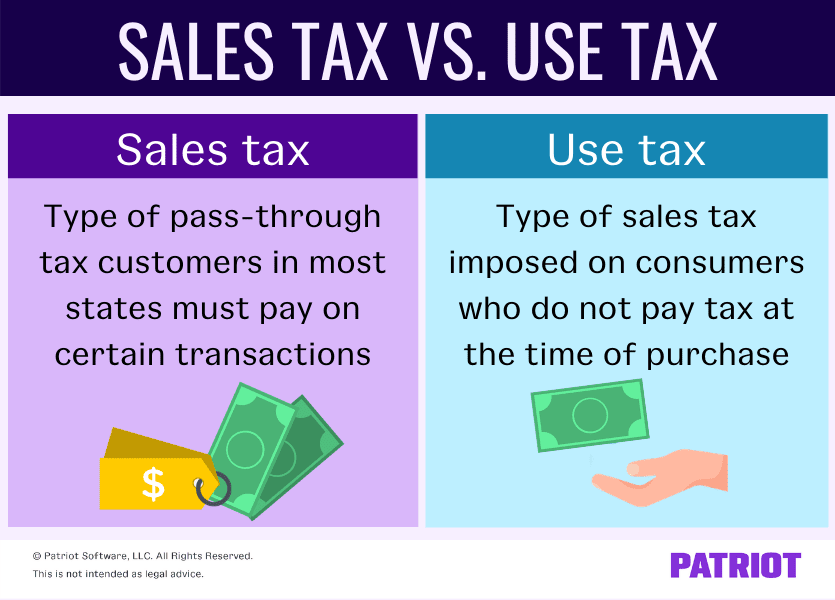

Sales Tax Vs Use Tax How They Work Who Pays More

How To Charge Sales Tax In The Us 2022

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Holidays Politically Expedient But Poor Tax Policy