does california have an estate tax or inheritance tax

As the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year.

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

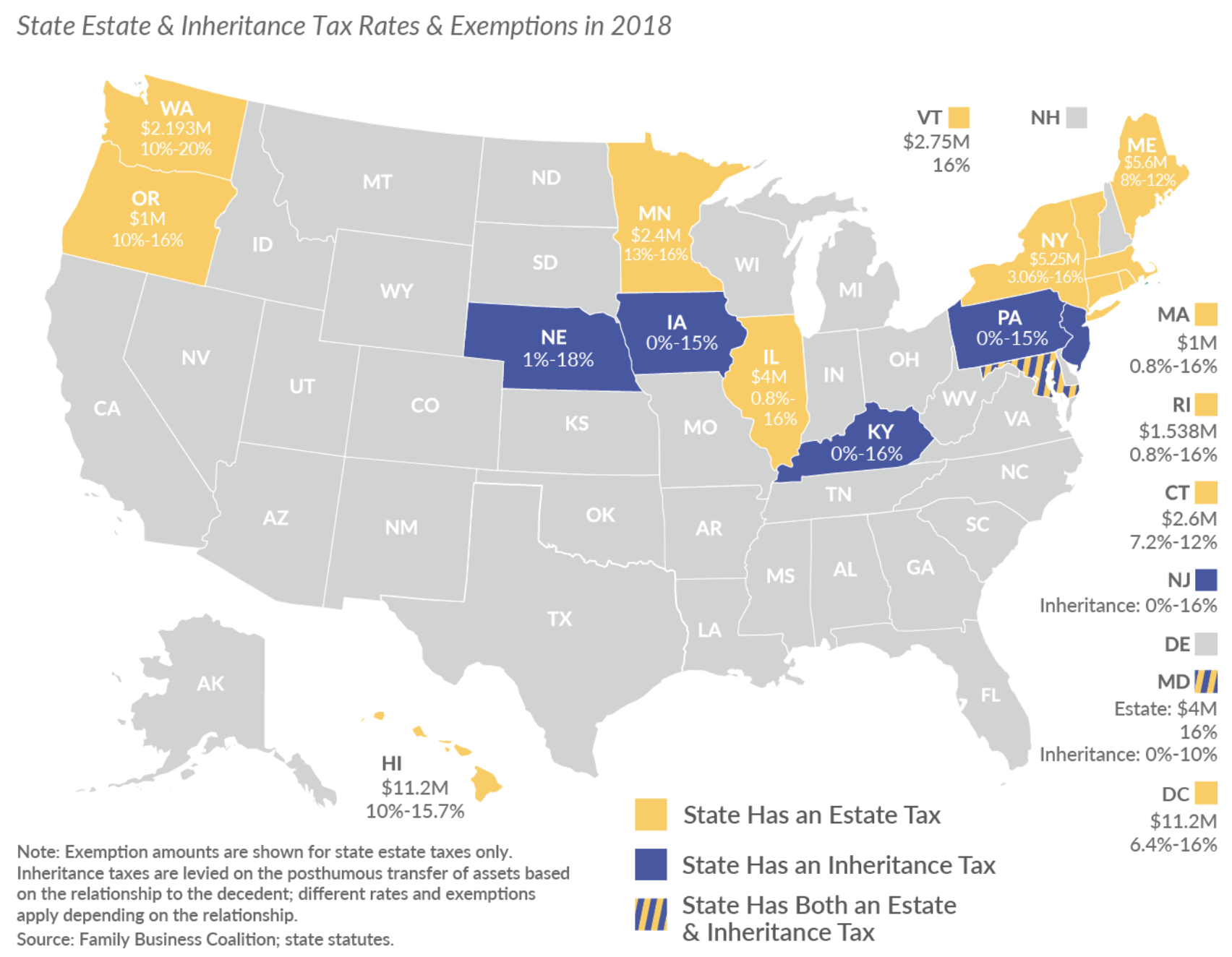

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

. In some cases it would be more important to preserve healthcare benefits than to receive the inheritance. Impose estate taxes and six impose inheritance taxes. We will address the difference shortly.

If you are getting money from a relative who lived in another state. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Gifting Gifting is one method of.

How does the California Inheritance Tax Work. Effective January 1 2005 the state. For example most states only tax estates valued over a certain dollar value.

Does not have a federal inheritance tax. In most states that impose an estate tax the tax is similar to its federal counterpart. After you die your representative will pay this tax out of your estate before assets are.

The federal government does not assess an inheritance tax. The good news is that the US. The state of California does not impose an inheritance tax.

California does not levy a gift tax. Does California Impose an Inheritance Tax. A giver can give anyone elsesuch as a relative friend or even a strangerup.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. The estate and executor personal representative still have quite a few obligations. Notably only Maryland has both an estate and an inheritance tax.

Maryland is the only state to impose both. California also does not have an inheritance tax. However California is not among them.

Like the majority of states there is no inheritance tax in California. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents. Twelve states and Washington DC.

California does have a state sales tax which can range from approximately 7 to 10. Proposition 19 was approved by California voters in the November 2020 election and will result in significant changes to the property tax benefits Californians enjoyed previously under the 1978 Proposition 13 law in effect previously. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritanceAnd even for.

California previously did have what was called an inheritance tax which acted similar to an estate tax the primary difference being that the tax was levied on the person receiving an inheritance as opposed to an estate tax which is levied against the estate itself before. However there are other taxes that may apply to your wealth and property after you die. Taxes and Inheritance Law.

Like most US. Please also consider joining one of our free online Estate Planning Webinars. The typical home inherited in Los Angeles County during the past decade had been owned by the parents for nearly 30 years.

The base tax rate is one of the highest in the country. If you have questions regarding inheritance taxes or any other estate planning needs please contact the Schomer Law Group for a consultation either online or by calling us at 310 337-7696. Two ways in which inheritance tax may be reduced or eliminated include gifting and donations.

The inheritance tax is sometimes called the death tax. As stated above California does not impose taxes on estates or inheritances. For 2021 the annual gift-tax exclusion is 15000 per donor per recipient.

How To Find Out Your Tax Rate. California is one of the 38 states that does not have an estate tax. No California estate tax means you get to keep more of your inheritance.

However the estate still has to file tax returns. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. California Inheritance Tax and Gift Tax.

California Legislators Repealed the State Inheritance Tax in 1981. Therefore when a California resident has beneficiaries in a state with an inheritance tax he or she should confer with an experienced California estate planning attorney regarding legal tax reduction methods. However the federal gift tax does still apply to residents of California.

We also offer a robust overall tax-planning service for high net-worth families. But local assessments can be a little bit lower. Read on for an overview of inheritance law in California.

California will not assess tax against Social Security benefits like many other states do. Just call 866 988-3956 or book an appointment online. In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

As of 2021 12 states plus the District of Columbia impose an estate tax. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002.

But this usually results from a confusion between the inheritance tax and the estate. We have offices throughout California and we offer in-person phone and Zoom appointments.

Taxes On Your Inheritance In California Albertson Davidson Llp

What Is An Estate Tax Napkin Finance

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Focus Shifts To State Estate Tax Planning Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is An Estate Tax Napkin Finance

Is Inheritance Taxable In California California Trust Estate Probate Litigation

The Property Tax Inheritance Exclusion

How Could We Reform The Estate Tax Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Much Is Inheritance Tax Community Tax

California Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

California Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center